If you are considering a metal roof, you have probably heard that it can lower your homeowners insurance. The good news is that this is often true. Metal roofs can reduce your insurance premiums, sometimes significantly. However, the answer is not as simple as a blanket "yes."

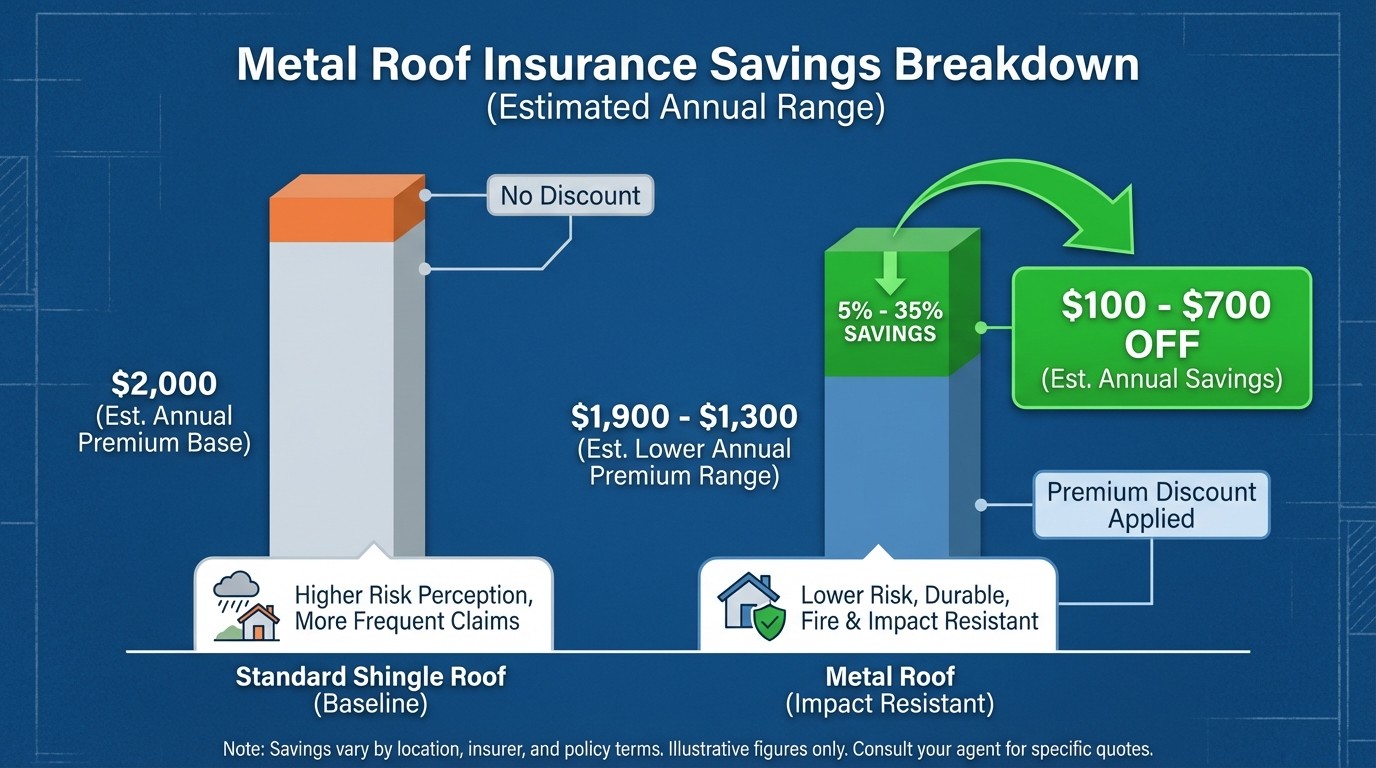

Insurance discounts for metal roofs depend on your location, your insurance company's policies, and the specific characteristics of your roof. Some homeowners save 5-35% on their dwelling coverage, translating to substantial metal roof insurance savings over time. Others see no discount at all. In rare cases, insurance rates can actually increase.

This guide explains when a metal roof lowers your insurance, how much you can expect to save, and what steps to take to maximize your discount.

The Short Answer: Yes, But It Depends

Does a metal roof lower your insurance? In most cases, yes. Many insurance companies offer discounts for metal roofs because they are more durable, fire-resistant, and longer-lasting than traditional asphalt shingles.

However, the discount varies widely. Homeowners in hail-prone states like Texas, Colorado, and Kansas often see larger discounts because metal roofs resist impact damage. As a result, homeowners in areas with less severe weather may see smaller savings or none at all.

The key factors that determine your discount include:

Your insurance company's specific metal roof discount programs

Your geographic location and local weather patterns

The age and condition of your metal roof

Whether your roof meets Class 4 impact and Class A fire ratings

How the roof was installed (professional installation typically required)

Before installing a metal roof specifically for insurance savings, contact your insurance agent. Ask about their metal roof discount policy and get the potential savings in writing. This helps you factor insurance savings into your overall return on investment. If you need help estimating your roof cost, use our free calculator to plan your budget.

Why Insurance Companies Favor Metal Roofs

Insurance companies calculate premiums based on risk. The less likely they are to pay a claim, the lower your rate. Metal roofs reduce that risk in several important ways.

Impact Resistance

Metal roofs can achieve a Class 4 impact resistance rating from Underwriters Laboratories (UL). This is the highest rating available. A Class 4 roof can withstand the impact of a 2-inch steel ball dropped from 20 feet without cracking or breaking.

For homeowners in hail-prone regions, this matters significantly. Hail damage is one of the most common roof insurance claims. When your roof can shrug off hail that would destroy asphalt shingles, insurers view your home as a lower risk.

Standing seam metal roofs perform particularly well in hail storms. The raised seams shed ice effectively. Additionally, the panels flex slightly to absorb impact energy. This design feature contributes to the high impact resistance ratings that qualify for insurance discounts.

Wind Resistance

Metal roofs are rated to withstand winds of 110-140 mph, depending on the product and installation. This is hurricane-grade protection. In contrast, asphalt shingles can start lifting and tearing off at 60-70 mph.

Wind damage claims cost insurance companies billions annually. A roof that stays intact during severe storms translates directly to fewer claims and lower rates for you. Metal panel systems with concealed fasteners are especially wind-resistant because there are no exposed edges for wind to catch and lift.

Fire Resistance

Metal roofs earn a Class A fire rating, the highest available. They will not ignite or spread flames. In wildfire-prone areas, this can be a major factor in both insurability and premium costs.

Some insurers in high-risk fire zones offer substantial discounts for metal roofs. On the other hand, they may refuse to insure homes with wood shake roofs entirely. In California and other western states affected by wildfires, a metal roof can mean the difference between affordable coverage and being unable to find insurance at any price.

Longevity

A quality metal roof lasts 40-70 years compared to 15-25 years for asphalt shingles. To understand how different roofing materials affect lifespan, check our detailed guide. This longevity means fewer replacement claims over time. Insurers factor roof age into their risk calculations, and a metal roof ages much more gracefully than alternatives.

The extended lifespan also means your roof maintains its protective qualities longer. While an asphalt roof might start losing granules and becoming vulnerable after 15 years, a metal roof continues providing full protection. This extended period of reliable performance is exactly what insurance companies want to see.

How Much Can You Save on Insurance With a Metal Roof?

Metal roof insurance discounts typically range from 5-35% on the dwelling coverage portion of your policy. The actual dollar amount depends on your base premium.

Here is what those percentages look like in real savings:

Annual Premium | 10% Discount | 20% Discount | 35% Discount |

|---|---|---|---|

$1,200 | $120/year | $240/year | $420/year |

$1,800 | $180/year | $360/year | $630/year |

$2,400 | $240/year | $480/year | $840/year |

Important note: The discount typically applies only to the dwelling coverage portion of your premium, not your entire bill. Liability coverage and other components usually remain unchanged.

Over a 50-year roof lifespan, even a modest 15% discount adds up. A homeowner saving $270 annually would accumulate $13,500 in metal roof insurance savings over the life of the roof. This helps offset the higher upfront cost of metal compared to asphalt. For a complete breakdown of roof replacement costs, see our 2026 pricing guide.

When calculating your potential savings, consider that insurance rates tend to increase over time. A percentage discount becomes more valuable as your base premium rises. What starts as $200 in annual savings could grow to $400 or more over the decades your metal roof protects your home.

Factors That Affect Your Metal Roof Insurance Discount

Several variables determine how much you will save when evaluating homeowners insurance metal roof discounts.

Geographic Location

Location is perhaps the biggest factor. States with frequent hail, high winds, or wildfires tend to offer the largest metal roof discounts. Texas, Florida, Colorado, Kansas, and Oklahoma homeowners often see significant savings. Conversely, homeowners in milder climates may see smaller discounts.

Insurance companies adjust their discount structures based on regional claim patterns. If metal roofs demonstrably reduce claims in your area, insurers have a financial incentive to encourage their installation through premium reductions. Want to know if your area has experienced recent hail? Use our hail storm impact checker to see if your home was affected.

Insurance Company Policies

Not all insurers treat metal roofs the same way. Some offer generous discounts. Others offer nothing. A few may actually charge more because metal costs more to replace than asphalt.

If your current insurer does not offer a metal roof discount, shop around. Different companies have different risk models and discount structures. Getting quotes from three or four insurers can reveal surprising differences in how they value your metal roof.

Roof Specifications

The specific characteristics of your metal roof matter. Insurance companies look for:

Class 4 impact resistance rating (UL 2218)

Class A fire resistance rating

Professional installation by a licensed contractor

Proper documentation from the manufacturer

Roofs meeting all these criteria qualify for maximum discounts. Budget metal roofs without proper ratings may not qualify at all. When selecting your roofing product, verify that it carries the certifications your insurer requires.

Roof Age

New metal roofs command better discounts than older ones. As your metal roof ages, the discount may decrease. However, because metal roofs maintain their integrity much longer than asphalt, you will likely keep some discount for decades.

Some insurers reassess roof discounts at regular intervals, such as every five or ten years. Understanding your insurer's policy helps you anticipate any changes to your premium over time.

When Metal Roofs Can Increase Insurance Costs

While rare, there are situations where a metal roof can actually increase your insurance rates.

Higher Replacement Cost

Metal roofs cost 2-3 times more than asphalt to replace. Insurance companies that use Replacement Cost Value (RCV) coverage may charge higher premiums to cover this increased replacement cost. The durability benefits often outweigh this factor, but not always.

To understand whether this applies to you, ask your insurer whether they price based on replacement cost and how that interacts with any durability discounts.

Regional Concerns

Some Florida insurers have increased rates for metal roofs in recent years due to fraud concerns in the roofing industry. This is not typical nationwide, but it illustrates that regional factors can override general expectations.

Before assuming you will receive a discount, check with insurers who write policies in your specific area to understand local pricing trends.

Metal Over Shingles

If a contractor installs metal roofing directly over existing shingles rather than removing the old roof, some insurers will not honor the metal roof discount. They view this installation method as potentially problematic because the underlying shingle condition cannot be verified.

For maximum insurance benefits, opt for a complete tear-off and fresh installation on properly inspected decking.

Older Metal Roofs

A 30-year-old metal roof, while still functional, may not qualify for new roof discounts. Insurers want to see documentation of recent installation to offer their best rates.

Before assuming you will save money, get a quote from your insurer based on your specific situation.

How to Get the Insurance Discount for Your Metal Roof

Follow these steps to maximize your homeowners insurance metal roof discount:

Contact your insurance agent before installation. Ask specifically about metal roof discounts and what documentation you will need.

Request details in writing. Get the discount percentage and any requirements documented so there are no surprises later.

Choose a roof with proper ratings. Specify Class 4 impact resistance and Class A fire resistance when selecting your metal roofing product.

Hire a licensed, certified installer. Most insurers require professional installation to honor discounts. Get a certificate of completion. Need guidance? Review our list of questions to ask a roofer before hiring.

Collect manufacturer documentation. Keep the product specifications, warranty information, and certification of ratings.

Submit documentation to your insurer. After installation, provide all paperwork and request a policy review.

Follow up on your premium adjustment. Verify that the discount appears on your next billing cycle.

If your current insurer does not offer a meaningful discount, consider shopping for a new policy. Insurance rates vary significantly between companies. Furthermore, switching providers after installing a metal roof often reveals better pricing options.

For additional guidance on navigating insurance claims and documentation, the Insurance Information Institute provides comprehensive resources on how premiums are calculated.