Hailstorms cause over $1 billion in property damage across the United States every year, according to NOAA's National Severe Storms Laboratory. If you live anywhere that experiences severe weather, your roof is at risk. The tricky part? Hail damage on a roof often goes unnoticed for months or even years, quietly allowing water intrusion that leads to costly repairs down the road.

The good news is that learning to spot hail damage roof signs is straightforward once you know what to look for. This guide walks you through exactly how to identify damage, decide whether to file an insurance claim, and take the right next steps to protect your home and your wallet.

Whether a storm just passed through your neighborhood or you are preparing for hail season, understanding roof hail damage puts you in control of the situation rather than leaving you guessing about what to do next.

How to Identify Hail Damage on Your Roof

Spotting hail damage requires knowing what to look for on different roofing materials. The signs vary depending on whether you have asphalt shingles, wood shakes, or metal roofing. Each material reacts differently to hail impact.

Signs of Hail Damage on Asphalt Shingles

Asphalt shingles cover about 75% of American homes, making them the most common roofing material you will encounter. When hail strikes asphalt shingles, look for these telltale signs:

Bruising or soft spots: Press gently on the shingle surface. If it feels soft like a bruised apple, hail has damaged the underlying structure and compromised the shingle's integrity.

Granule loss: Check for bare spots where the protective granules have been knocked off, exposing the black asphalt layer underneath. These spots often appear shiny in sunlight.

Random dent patterns: Hail damage appears randomly across the roof surface, not in organized patterns. If you see uniform damage, it likely has another cause.

Exposed fiberglass mat: Severe hail impacts can shatter the shingle surface and expose the fiberglass mat layer beneath, leaving the roof vulnerable to water penetration.

Cracked or split shingles: Large hailstones can cause visible cracks or splits in shingles, especially in older roofs where the material has become more brittle over time.

Your gutters tell a story too. After a hailstorm, check your downspouts and the ground beneath them for accumulated granules. Some granule loss is normal over a roof's lifespan, but finding large amounts of granules after a storm indicates significant damage has occurred.

Damage Signs on Wood and Metal Roofs

Wood shakes show hail damage differently than asphalt. Look for splits with sharp edges and orange or brown coloring at the break point. Fresh hail damage appears cleaner than age-related cracking, which shows weathered, gray edges.

Metal roofs dent rather than crack or lose material. While these dents are often cosmetic, severe impacts can compromise protective coatings and lead to rust over time if left unaddressed.

Ground-Level Damage Indicators

You do not need to climb on your roof to find evidence of hail damage. In fact, walking on a damaged roof can cause additional problems. Check these areas safely from the ground first:

Dents on metal gutters and downspouts (above 5 feet, where lawnmowers and other equipment cannot reach)

Dings and dents on your garage door or painted wood surfaces like window trim and shutters

Holes punched through window screens

Dents on your air conditioning unit, outdoor grill, or metal patio furniture

Damage to your car's hood, roof, and trunk

Marks on wooden deck surfaces or fencing

Finding any of these signs strongly suggests your roof sustained damage too. The same hail that dented your car did not skip over your roof. Use a storm damage checklist to document everything systematically before contacting anyone.

What Size Hail Damages a Roof?

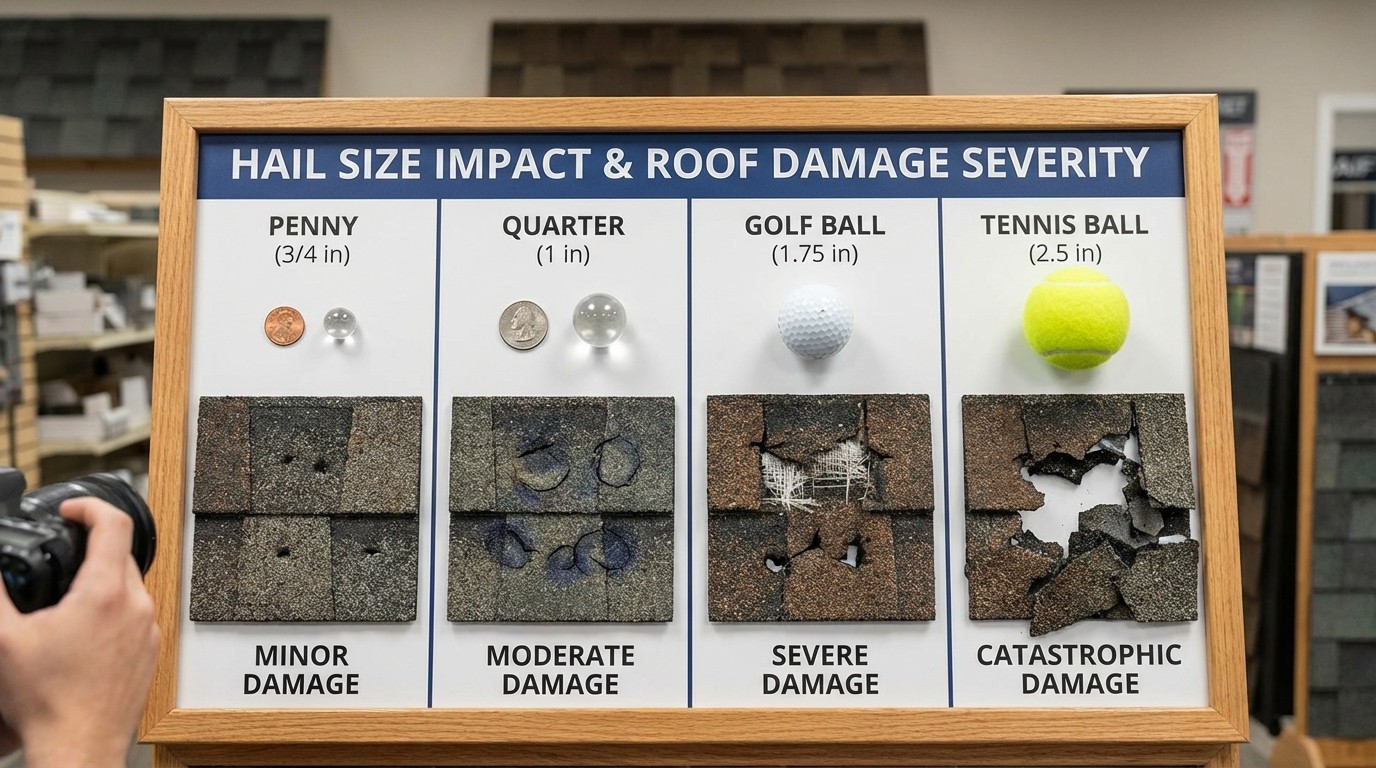

Not all hail causes significant damage. The size of hailstones directly correlates with the severity of roof damage you can expect to find.

Hail Size Reference Guide

Hail Size | Common Comparison | Typical Damage |

|---|---|---|

3/4 inch | Penny | Minor granule displacement, slight dents in soft metals |

1 inch | Quarter | Bruising to shingles, significant granule loss, gutter damage |

1.25 inches | Half dollar | Cracked shingles, exposed underlayment possible |

1.5 inches | Golf ball | Severe cracking, punctures to soft materials like vents |

2+ inches | Tennis ball | Major structural damage, immediate replacement likely needed |

Hail needs to be approximately 1 inch in diameter to cause clear, noticeable damage to asphalt shingles. However, smaller hail combined with high winds can still cause problems over time, especially if storms occur repeatedly in your area.

Wind direction and speed during the storm matter significantly. Hail driven by 60 mph winds strikes at an angle, potentially causing more damage on one side of your roof than another. This explains why your neighbor's roof might show more damage than yours, even though you experienced the same storm.

Want to know if your specific address was in a recent hail path? You can check if your home was hit using weather data tools that track storm paths and hail reports.

Should You File an Insurance Claim for Hail Damage?

Deciding whether to file a claim requires weighing several factors carefully. Not every instance of hail damage warrants involving your insurance company, and filing can have long-term consequences for your premiums.

When Filing Makes Sense

File a claim when:

Damage is extensive: Multiple areas of your roof show clear signs of hail impact, not just one or two spots.

Repair costs significantly exceed your deductible: If repairs cost $8,000 and your deductible is $1,000, filing makes obvious financial sense. The $7,000 payout justifies any potential premium increase.

Damage affects roof performance: Leaks, exposed underlayment, cracked shingles, or compromised flashing all indicate your roof cannot adequately protect your home.

Professional inspection confirms damage: A qualified roofer identifies problems you might have missed from the ground.

When to Skip Filing

Consider not filing when:

Damage is purely cosmetic: A few minor dents that do not affect water resistance or structural integrity may not justify the claim.

Costs barely exceed your deductible: If repairs cost $1,500 with a $1,000 deductible, the $500 payout may not be worth potential premium increases that could cost you more over several years.

Your policy has a separate wind/hail deductible: Some policies in hail-prone states like Texas, Colorado, and Oklahoma have percentage-based deductibles calculated on your home's insured value, which can result in $5,000 to $15,000 out-of-pocket costs.

Timeline Considerations

Most insurance policies allow up to one year from the date of the storm to file a hail damage claim, according to the Insurance Information Institute. However, waiting too long creates problems. Insurance companies have access to sophisticated weather tracking data and can determine exactly when storms hit specific addresses.

Document damage promptly, even if you decide to wait before filing. Fresh photos and detailed notes strengthen any claim you decide to pursue later. Waiting also allows secondary damage like leaks to develop, which complicates your claim.

Learn more about getting insurance to pay for roof replacement to understand the complete process from start to finish.

The Insurance Claim Process for Hail Damage

Filing a hail damage claim follows a predictable process. Knowing what to expect at each stage helps you navigate it successfully and maximize your chances of a fair settlement.

Step 1: Document Everything

Before contacting your insurance company, gather evidence:

Take clear photos and videos of all visible damage from multiple angles

Note the exact date of the storm that caused the damage

Save any weather alerts, news reports, or hail reports for your area

Make temporary repairs if needed to prevent further damage (keep all receipts)

Write down your own observations while they are fresh in your memory

Step 2: Contact Your Insurance Company

Call your agent or the claims hotline to open a claim. Many companies now offer mobile apps that streamline the filing process. Provide your policy number, the storm date, and a general description of the damage you have observed. Avoid speculating about repair costs at this stage.

Step 3: Schedule the Adjuster Visit

Your insurance company will send an adjuster to inspect the damage in person. Request to be present during this inspection if possible. Walk through the property with the adjuster, point out all damage you have documented, and ask questions about anything unclear in their assessment.

Step 4: Get Contractor Estimates

Obtain written estimates from at least two reputable local roofing contractors before the adjuster arrives or shortly after. These estimates help ensure the insurance payout covers actual repair costs in your market. Contractors familiar with insurance work can also identify damage that adjusters sometimes miss.

Step 5: Review and Negotiate If Needed

Compare the adjuster's assessment to your contractor estimates. If the numbers differ significantly, you have options. Request a re-inspection, provide additional documentation supporting higher costs, or ask about supplemental claims for items initially missed.

Warning: Be cautious of "storm chaser" contractors who show up unsolicited after hailstorms offering free inspections. Many are legitimate businesses, but some use high-pressure tactics, demand large deposits, or disappear after collecting payment.

Working with a Roofing Contractor After Hail Damage

Choosing the right contractor makes the difference between a smooth repair process and a frustrating, expensive experience.

Why Professional Inspection Matters

While you can spot obvious damage from the ground, professional roofers identify issues invisible to untrained eyes. They can:

Detect hidden damage like fractured fiberglass mats beneath surface granules

Assess whether targeted repairs or full replacement makes more financial sense

Provide detailed documentation that strengthens insurance claims

Distinguish between pre-existing wear and actual storm damage

Most reputable local contractors offer free inspections after storms. Take advantage of this, but be wary of anyone pressuring you to sign a contract immediately.

Questions to Ask Before Hiring

Before signing with any contractor, ask these essential questions:

Are you licensed and insured to work in this state?

How long have you been operating in this local area?

Can you provide references from recent hail damage repair jobs?

Will you work directly with my insurance company on documentation?

What warranty do you offer on both labor and materials?

Do you use your own crews or subcontract the work?

Red Flags to Watch For

Avoid contractors who:

Demand large upfront deposits before starting work

Pressure you to sign contracts immediately after inspections

Offer to waive or cover your insurance deductible (this constitutes insurance fraud)

Cannot provide current proof of insurance and licensing

Have no local physical address or verifiable business history

Refuse to provide written estimates or contracts

Getting multiple quotes from different contractors protects you from overpaying and helps identify the most qualified professional for your situation.