A roof insurance claim can save you thousands of dollars after storm damage, but most homeowners leave money on the table. They either miss the filing deadline, fail to document damage properly, or accept the first offer without question.

Filing a roof insurance claim does not have to be confusing. The process follows clear steps, and understanding them puts you in control. This guide walks you through every phase, from documenting damage on day one to collecting your final payment.

Most roof insurance claims take 30 to 60 days from filing to payout. Knowing what to expect helps you avoid mistakes that delay your settlement. Whether you are dealing with hail damage, wind damage, or a fallen tree, the steps remain the same.

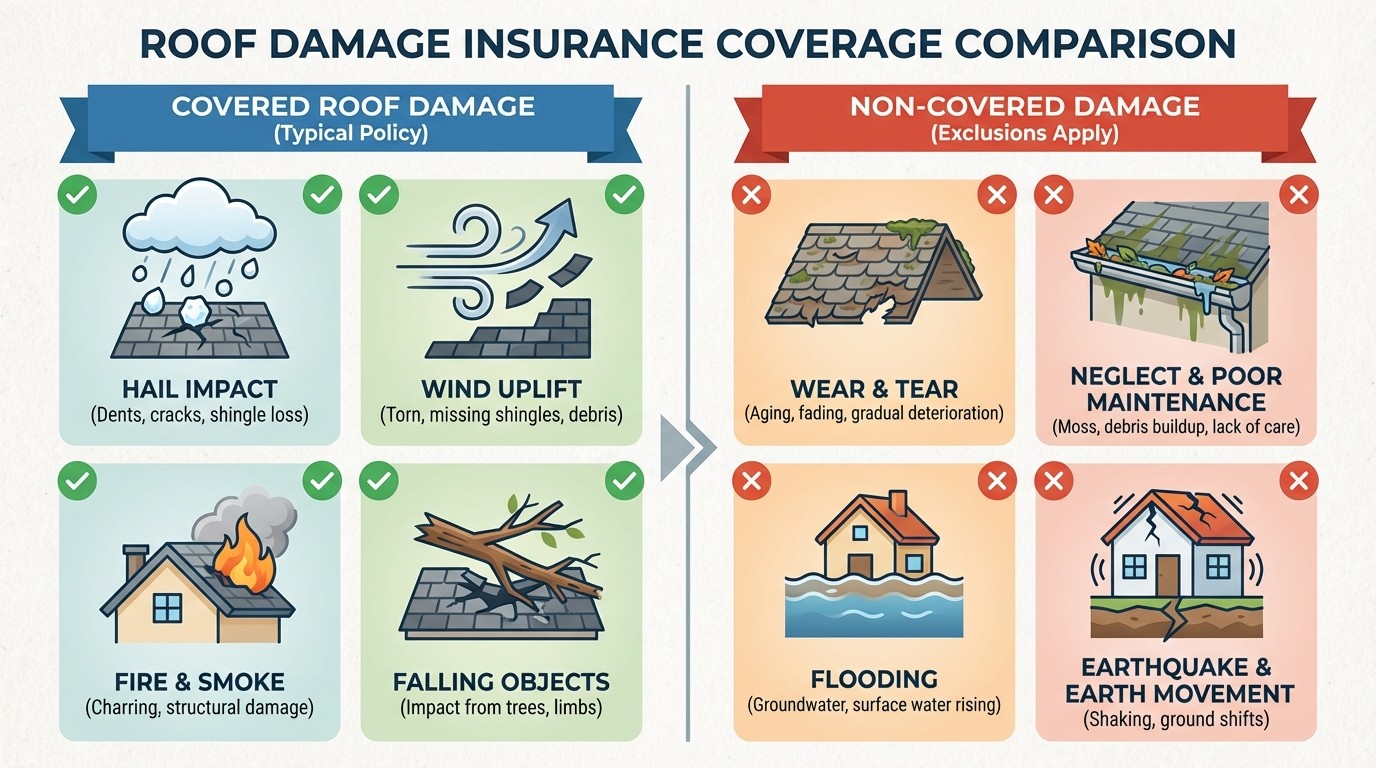

What Roof Damage Does Homeowners Insurance Cover?

Homeowners insurance typically covers roof damage that happens suddenly and accidentally. This includes storm damage from hail, high winds, and falling tree limbs. Lightning strikes and fire damage are also covered under most standard policies.

The key phrase insurance companies use is "sudden and accidental." If a hailstorm dents your shingles or wind tears off a section of your roof, that qualifies. According to the National Association of Insurance Commissioners, wind and hail claims average $12,000 to $15,000 for residential roofs.

However, insurance does not cover everything. Damage from wear and tear, aging, or neglect falls outside your policy. If your roof is 20 years old and shingles are curling from age, that is maintenance, not covered damage. If you ignored a small leak that became a big problem, the insurer may deny the claim citing negligence.

What Is Typically Covered:

Hail damage to shingles, vents, gutters, or skylights

Wind damage including lifted, cracked, or missing shingles

Falling trees, large branches, or heavy debris

Fire and lightning strikes causing direct damage

Weight of ice or snow causing sudden structural failure

What Is Typically NOT Covered:

Normal wear and tear from aging and weathering

Neglected maintenance issues that worsen over time

Cosmetic damage that does not affect roof function

Flood damage (requires a separate flood insurance policy)

Earthquake damage (requires a separate earthquake policy)

Damage from poor original installation or workmanship

Before filing a roof insurance claim, review your policy declarations page. It lists your coverage limits, deductible amount, and any exclusions. Some policies exclude cosmetic hail damage, meaning the dents must affect your roof's function before coverage applies.

How Do Roof Insurance Claims Work?

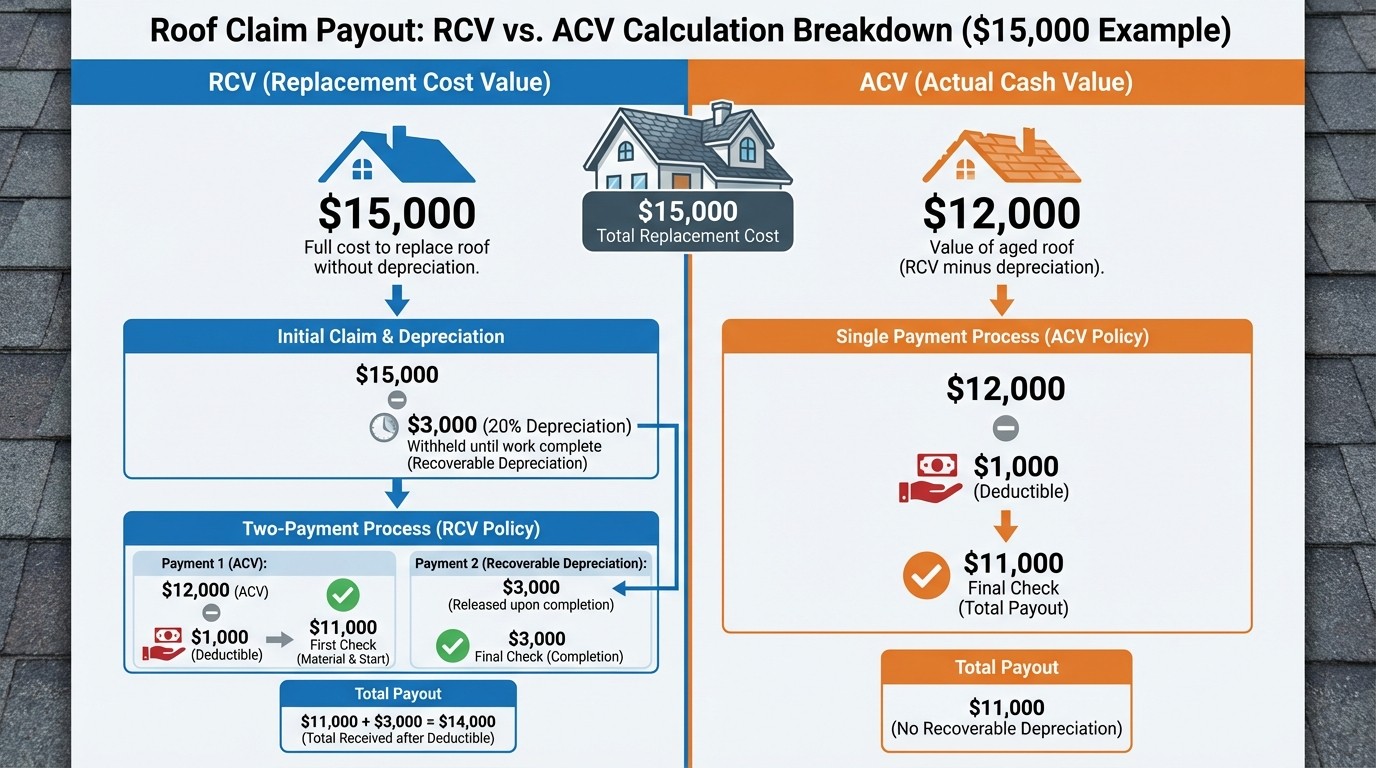

Understanding how roof insurance claims work helps you set realistic expectations for your payout. Two key terms determine how much you receive: Replacement Cost Value (RCV) and Actual Cash Value (ACV).

Replacement Cost Value (RCV) is the full cost to replace your damaged roof with new materials without deduction for depreciation. If a new roof costs $15,000, that is your RCV amount.

Actual Cash Value (ACV) is the RCV minus depreciation for age and wear. If your 10-year-old roof has used 50% of its lifespan, the ACV might be $7,500. The insurance company calculates depreciation based on your roof's age, condition, and materials.

Most policies pay claims in two payments. First, you receive an ACV check representing the depreciated value. After completing repairs, you submit proof of completion and receive the remaining "recoverable depreciation." This second payment brings your total to the full RCV amount.

Here is an example calculation:

Replacement cost for new roof: $15,000

Current roof age: 10 years (40% depreciated based on 25-year lifespan)

Depreciation amount: $6,000

Your deductible: $2,500

Initial ACV payment: $15,000 - $6,000 - $2,500 = $6,500

After repairs completed: Recoverable depreciation = $6,000

Total amount received: $12,500

Your deductible is the amount you pay out of pocket before insurance kicks in. Deductibles typically range from $1,000 to $2,500. However, some policies use percentage-based deductibles of 1% to 2% of your home's insured value. On a $400,000 home, a 1% deductible equals $4,000. Understanding how to get insurance to pay for roof replacement helps maximize your payout.

Step-by-Step: How to File a Roof Insurance Claim

Filing a roof damage insurance claim follows seven clear steps. Completing each step correctly increases your chances of receiving a full payout.

Step 1: Document the Damage Immediately

Take photos and videos of all visible damage before making any repairs. Capture wide shots showing overall damage and close-ups of damaged shingles, dented vents, and interior water damage. Record the date and time of the storm and save weather reports. This documentation becomes critical evidence for your roof insurance claim.

Step 2: Review Your Insurance Policy

Find your policy declarations page. Note your coverage limits, deductible, and any exclusions. Check your filing deadline. Most policies require claims within one year of the damage, though some states allow longer windows.

Step 3: File the Claim With Your Insurance Company

Call your insurance company's claims hotline or file online. Provide the date of the storm, type of damage, and your policy number. Request a claim number and the name of your assigned adjuster. Keep records of every conversation including dates and what was discussed.

Step 4: Schedule the Adjuster Inspection

The insurance company will send a claims adjuster to inspect your roof damage. This inspection typically happens within 7 to 14 days of filing your claim. Make sure you or someone you trust is present during the entire inspection. The adjuster will document the damage they observe and create an initial repair estimate.

Step 5: Get Your Own Contractor Estimate

Before accepting the insurance company's estimate as final, get at least one independent quote from a licensed roofing contractor. If the contractor's estimate is significantly higher than the insurance estimate, you can use it to supplement your claim. Many initial insurance estimates miss hidden damage or undervalue certain repair items.

Step 6: Review the Claim Decision Carefully

The insurance company will send a written claim decision and detailed payment breakdown. Review it carefully against your documentation and contractor estimates. Compare the scope of work to ensure all damaged items are included. If items are missing or undervalued, you have the right to dispute the decision and request a re-inspection or submit additional documentation.

Step 7: Complete Repairs and Claim Recoverable Depreciation

Hire a qualified, licensed contractor and complete all necessary repairs. Keep all receipts, invoices, and the final itemized bill. Submit proof of completion to your insurance company to collect the recoverable depreciation. This final payment often adds $3,000 to $6,000 or more to your total settlement.

The typical storm damage roof insurance claim takes 30 to 60 days from initial filing to final payment. Complex claims involving disputes or extensive damage may take 90 days or longer. You can check if your address was hit by a recent hailstorm to validate storm damage in your area before filing.

Working With Insurance Adjusters and Contractors

The insurance adjuster works for the insurance company, not for you as the homeowner. They are trained to assess damage fairly and accurately, but their estimate often represents the minimum acceptable repair cost. Knowing how to work effectively with both adjusters and contractors helps you get a fair settlement for your roof damage insurance claim.

Getting a Contractor's Independent Perspective:

After the adjuster visit, have a licensed roofing contractor inspect your roof independently. Experienced contractors often find damage that adjusters missed, including problems with underlayment, flashing, pipe boots, or decking that are not visible from the ground or a quick visual inspection.

If the contractor's estimate exceeds the insurance estimate by a significant amount, you can file what is called a "supplement." A supplement formally requests additional payment for repair items not included in the original insurance estimate. Most roof insurance claims require at least one supplement to capture the full scope of necessary repairs.

Choosing the Right Contractor:

Work with a contractor who has specific experience handling insurance claims. They should understand the supplementing process thoroughly and be willing to provide detailed documentation supporting their estimate. Avoid contractors who pressure you to sign agreements before your claim is fully approved and funded.

Never let a contractor tell you they will completely "handle" your insurance claim on your behalf. You should never sign over your claim rights. Maintain direct control of all communication with your insurance company throughout the process.

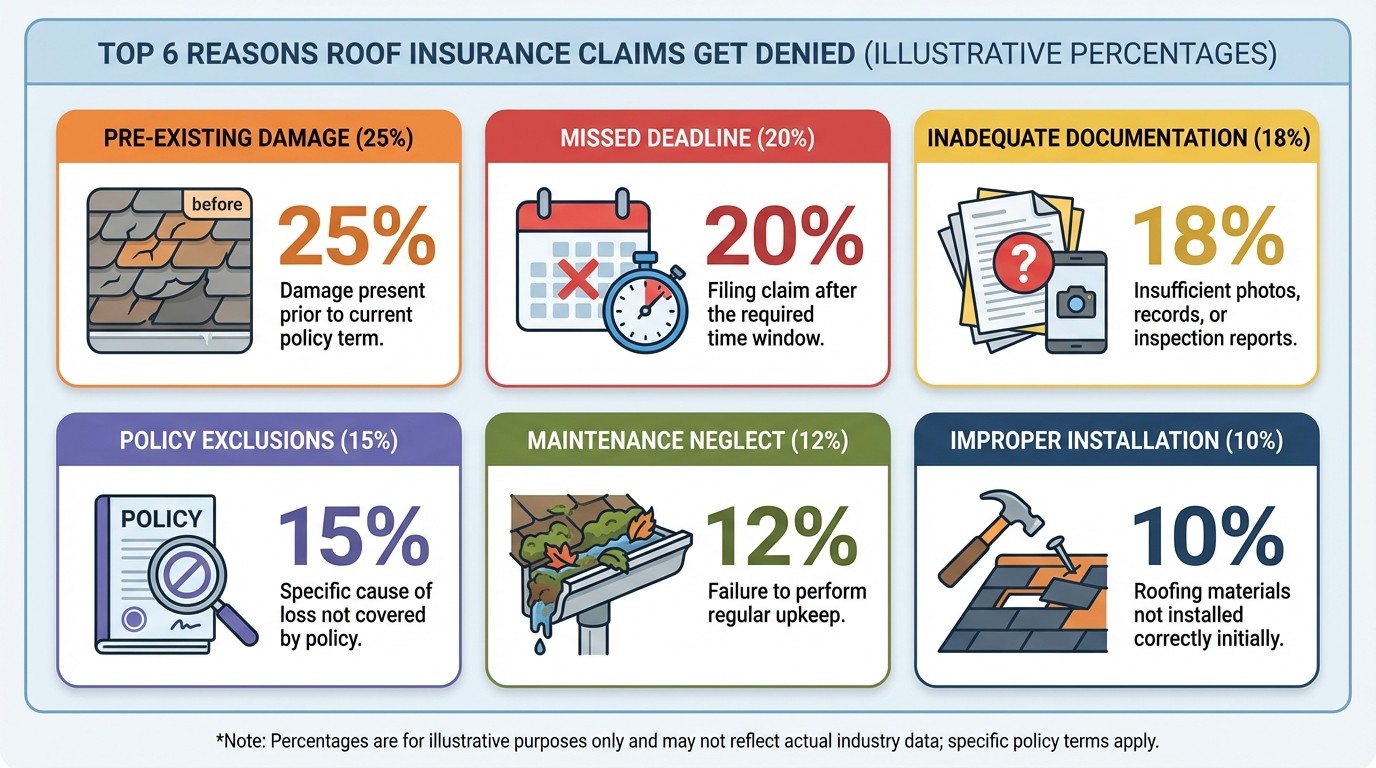

Common Reasons Roof Insurance Claims Get Denied

Approximately 15% to 20% of roof insurance claims are initially denied by insurance companies. Understanding why claims get rejected in the first place helps you avoid these common pitfalls and present a stronger claim.

Every state has a statute of limitations for filing insurance claims. Most require you to file within one to two years of the damage occurring. Some policies have even shorter internal deadlines requiring notification within 60 or 90 days. File promptly after discovering any damage to protect your rights.

Inadequate Documentation

Claims submitted without photos, videos, or detailed inspection reports are significantly easier to deny. Document everything thoroughly from day one after the storm. If you made temporary repairs to prevent further damage, photograph the damage before covering or sealing it.

Policy Exclusions

Some policies specifically exclude certain types of damage from coverage. Cosmetic damage clauses exclude hail dents that do not affect the roof's function. Wind and hail exclusions exist in some high-risk areas like coastal regions. Read your policy carefully to understand your specific coverage before a storm hits.

Maintenance Neglect

If the adjuster determines that proper regular maintenance would have prevented the damage from occurring, they may deny the claim citing owner negligence. Regular roof inspections and timely repairs to minor issues demonstrate responsible homeownership. Be aware of common roofing scams that specifically target vulnerable homeowners after storms.

Improper Original Installation

If your roof was not installed correctly by the original contractor and the damage directly relates to that installation defect, your homeowners claim may be denied. The insurer may instead direct you to pursue a claim against the original installer or their insurance carrier.

How to Appeal a Denied Roof Insurance Claim

A denied claim is not necessarily the end of the road for your roof insurance claim. You have the legal right to appeal the decision, and many initially denied claims are later approved with proper additional documentation and persistence.

Request the Denial in Writing

Ask your insurance company for a formal written denial letter. This letter must explain the specific reason for denial and cite the exact policy language they relied upon in making their decision. Understanding the precise reason for denial helps you build a targeted and effective appeal.

Gather Additional Evidence

Address the denial reason directly with new supporting evidence. If they claim pre-existing damage, get an independent professional inspection report specifically showing the damage is storm-related rather than from wear. If they cite inadequate documentation, provide additional photos, official weather reports from that date, or witness statements from neighbors.

Get Professional Help for Larger Claims

Consider hiring a public adjuster or insurance attorney for claims involving significant damage amounts. Public adjusters are licensed professionals who work on your behalf to negotiate with the insurance company. They typically charge 10% to 15% of the final settlement amount as their fee. Attorneys may work on contingency for wrongfully denied claims, meaning they only get paid if you win.

File a Regulatory Complaint if Needed

If direct negotiations with the insurance company fail to produce results, file a formal complaint with your state's insurance commissioner or department of insurance. Insurance companies are required to respond to regulatory complaints within specific timeframes, and this often prompts a more serious second review of your claim.

Appeals typically take an additional 30 to 90 days to resolve. The effort and time investment is worthwhile for claims of $10,000 or more. For smaller claims close to your deductible amount, carefully weigh the time investment against the potential additional recovery.

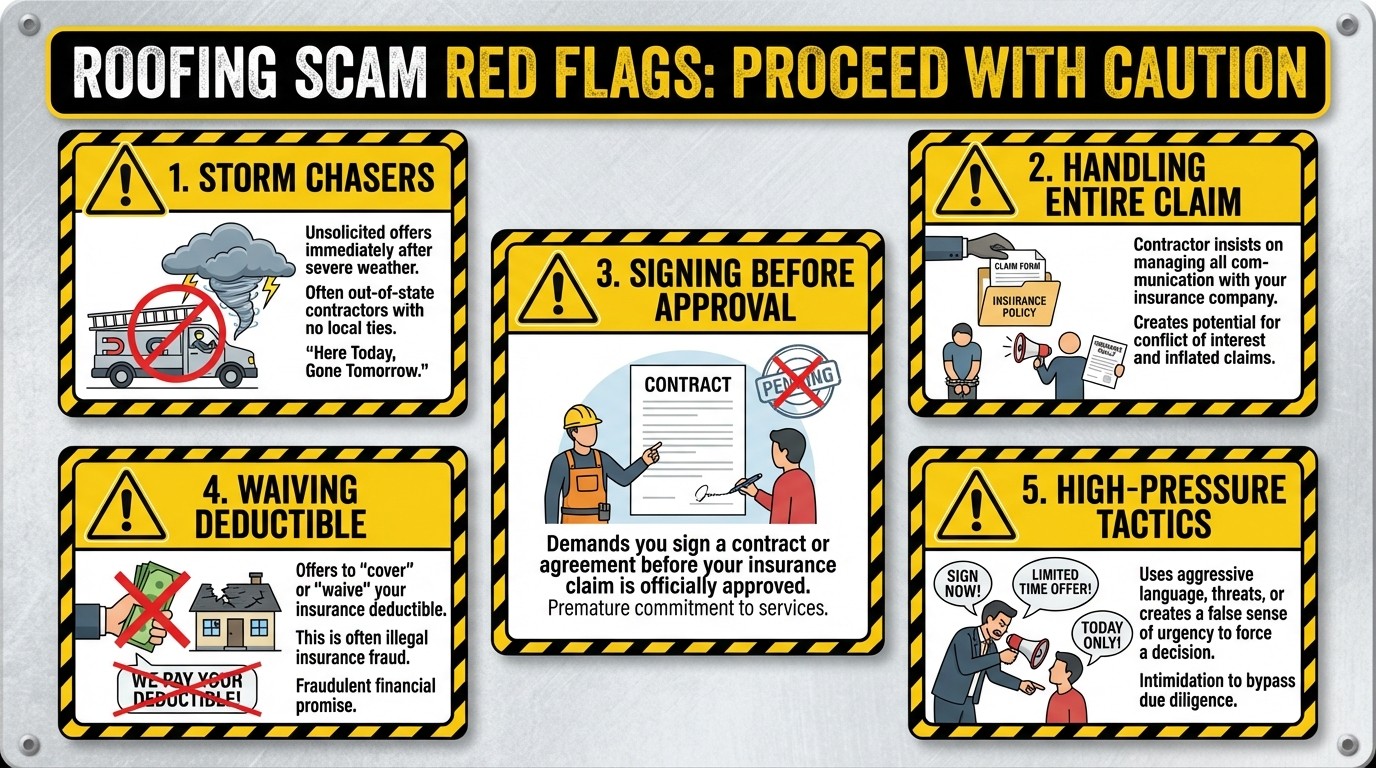

Red Flags and Scams to Avoid During the Claim Process

Storm damage unfortunately brings out both legitimate contractors and scam artists looking to take advantage of vulnerable homeowners. Protect yourself and your money by recognizing these warning signs.

Be very cautious of any contractor who offers to completely "take care of" your insurance claim. While assisting with paperwork and estimates is acceptable and even helpful, you should never sign over your claim rights or allow a contractor to speak with your insurance company on your behalf without your direct involvement. Maintain control of all communication with your insurer.

Signing Contracts Before Claim Approval

Never sign a roofing contract before your claim is approved and you fully understand your payout amount. Legitimate, reputable contractors understand this process and will wait for claim approval before requiring a signed agreement. Pressure to sign immediately is a major red flag indicating potential problems.

Offers to Waive Your Deductible

If any contractor offers to waive your deductible or "absorb" it as part of their pricing, walk away immediately. This is insurance fraud in most states. The contractor will either inflate the claim amount to secretly cover the deductible or cut corners on materials and labor quality. Either scenario puts you at significant legal and financial risk.

High-Pressure Sales Tactics

Scammers create artificial urgency to force quick decisions. They claim material prices are going up tomorrow, supplies are limited, or you must decide today to get their "special storm pricing." Quality contractors give you adequate time to make informed decisions and compare quotes from multiple companies.