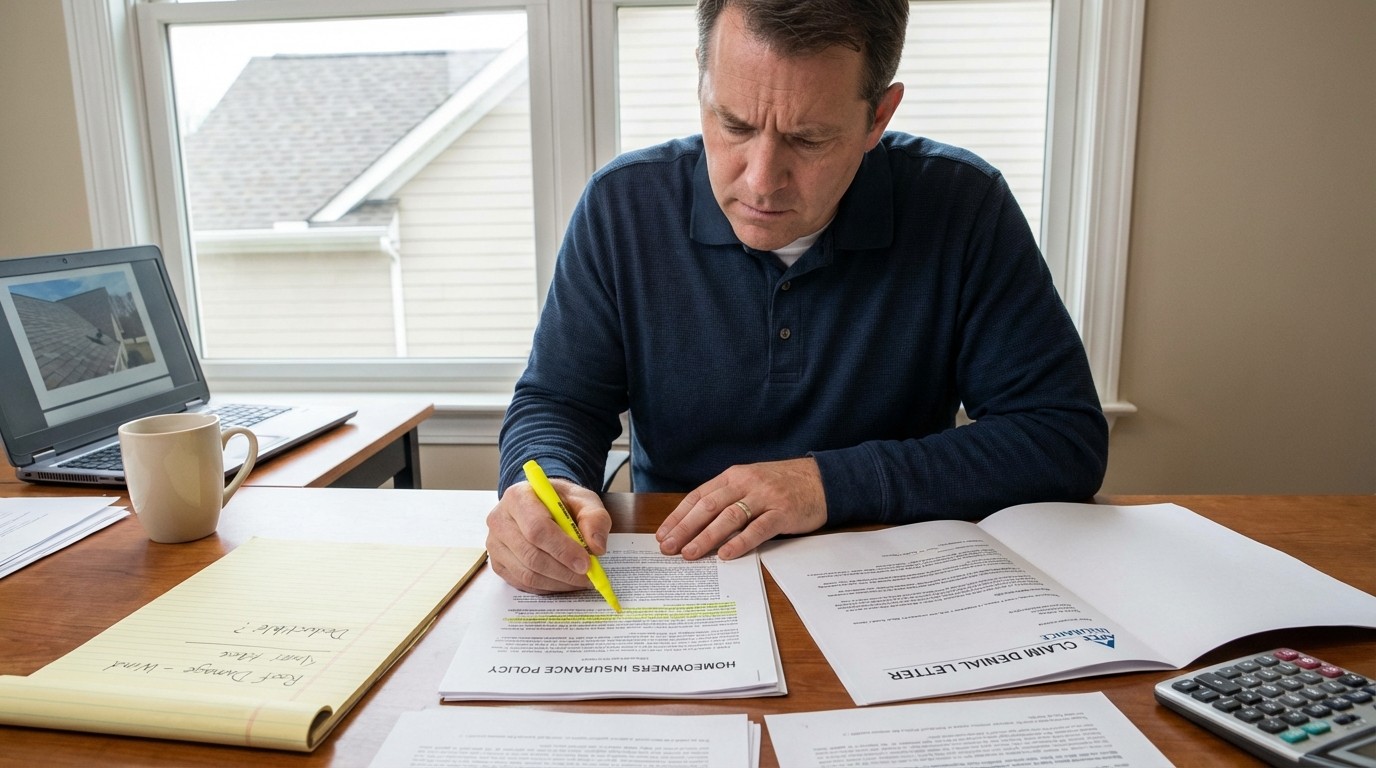

Finding out your roof insurance claim denied letter arrived in the mail can feel like a punch to the gut. You filed the claim expecting help, and now you are left wondering what went wrong and what comes next.

The good news is that a denial is not always the final answer. Many homeowners successfully appeal their denied roof claims and get the coverage they deserve. According to industry data from the National Association of Insurance Commissioners, roughly 30 percent of initially denied claims are overturned on appeal when homeowners provide proper documentation.

This guide walks you through exactly what to do when your roof insurance claim gets denied. You will learn the most common reasons for denial, how to file an effective appeal, and when it makes sense to bring in professional help.

Why Your Roof Insurance Claim Gets Denied

Insurance companies deny roof claims for several specific reasons. Understanding why your roof insurance claim was denied is the first step toward building a successful appeal. Each reason requires a different approach to overcome.

Lack of Maintenance

Insurers expect homeowners to maintain their roofs. If the adjuster sees signs of neglect, like missing shingles that were never replaced or clogged gutters causing damage, they may blame the problem on poor upkeep rather than a covered event.

Regular maintenance includes replacing damaged shingles, clearing debris, trimming overhanging branches, and scheduling periodic inspections. If you have records of maintenance work, these can help counter claims of neglect.

Age and Wear

Most policies cover sudden damage, not gradual deterioration. If your roof is 20 years old and showing its age, the insurance company may argue the damage is from normal wear rather than a storm or other covered peril.

Asphalt shingle roofs typically last 20 to 25 years. If your roof is nearing the end of its expected lifespan, insurers scrutinize claims more closely. However, age alone does not disqualify storm damage. A 15-year-old roof can still suffer covered hail damage.

Pre-Existing Damage

When the adjuster finds damage that existed before the claim event, expect a denial. This is why documenting your roof condition before storms hit matters so much. Photos from previous years can prove your roof was in good shape before the incident.

Policy Exclusions

Some policies exclude certain types of damage. For example, cosmetic damage from hail may not be covered under your specific policy. Review your policy language carefully to understand what is and is not included.

Common exclusions include:

Cosmetic damage that does not affect roof function

Damage from certain types of storms in high-risk areas

Roofs over a certain age without special endorsements

Specific roofing materials like wood shakes in some regions

Filing Errors

Missing deadlines or incomplete paperwork gives insurers an easy reason to deny claims. Most policies require you to report damage within a specific timeframe, often 60 to 90 days. Some policies have shorter windows, so check your coverage immediately after damage occurs.

Disputed Cause of Damage

Sometimes homeowners and adjusters disagree about what caused the damage. The insurance company might claim wind damage was actually caused by age, or that a leak started before the storm you reported. This is one of the most common reasons for denied roof insurance claims and often the best candidate for a successful appeal.

What to Do When Your Roof Insurance Claim Is Denied

When your roof insurance claim denied letter arrives, take action quickly. The steps you take in the first few days matter significantly for your appeal chances.

Read the Denial Letter Carefully

The letter must explain why your claim was denied. Look for the specific reason or reasons listed. This information tells you exactly what you need to address in your appeal. Keep this letter safe as it becomes the foundation of your appeal strategy.

Review Your Policy

Pull out your actual policy documents, not just the summary. Compare the denial reason against your coverage terms. Sometimes adjusters make mistakes or misinterpret policy language. Look for the specific section your insurer cited and read the full context.

Pay attention to:

Coverage limits and deductibles

Specific perils covered (named perils vs. all-risk)

Exclusions that might apply

Deadlines for reporting and appeals

Check the Timeline

Note when the denial was issued and find out your deadline to appeal. Most insurance companies give you 30 to 60 days to file an appeal, but this varies by company and state. Missing this window can eliminate your right to challenge the decision.

Do Not Sign Anything Yet

If your insurer sends a settlement offer or asks you to sign forms accepting the denial, hold off. Signing could limit your options for appeal. Even if you eventually accept a partial settlement, you want to explore your full options first.

Start Documenting

Take new photos of your roof damage if you have not already. Write down your recollection of events leading to the damage. Gather any weather reports or news coverage from the date of the incident. This evidence supports your case that a covered event caused the damage.

Request Your Claim File

You have the right to see everything in your claim file. Send a written request to your insurer asking for copies of all documents, photos, and the adjuster's notes. This reveals exactly what evidence the company used to deny your claim and helps you identify weaknesses in their reasoning.

How to Appeal a Denied Roof Insurance Claim

When your roof insurance claim is denied, the appeals process gives you a formal way to challenge the insurance company's decision. Here is how to approach it strategically.

Write a Formal Appeal Letter

Your letter should clearly state that you are appealing the denial. Reference your claim number, policy number, and the date of the denial. Address each reason for denial point by point, explaining why you believe the decision was wrong.

Keep the tone professional and factual. Emotional appeals rarely work. Stick to evidence and policy language.

Provide New Evidence

Strengthen your case with additional documentation. This might include:

Photos taken immediately after the damage occurred

Contractor estimates showing the damage is consistent with the covered event

Weather reports proving severe conditions on the date in question

A second opinion from an independent roofing inspector

Statements from neighbors about damage to their homes

Get an Independent Inspection

Hiring a licensed roofer to inspect your roof and provide a written report can make a significant difference. Look for someone with experience in storm damage assessments who can speak to the cause and extent of damage.

The inspector should document:

Type and extent of damage

Likely cause of damage

Age and general condition of the roof

Estimated repair or replacement cost

Consider a Public Adjuster

Unlike company adjusters who work for the insurer, public adjusters represent homeowners. They know how to document claims, interpret policy language, and negotiate with insurance companies. They typically charge 10 to 15 percent of the settlement.

Public adjusters are particularly valuable when:

The claim is large and complex

The insurance company's estimate seems low

You feel outmatched by the insurer's expertise

Be Persistent but Professional

Keep records of every phone call, including the date, time, and name of the person you spoke with. Follow up in writing after important conversations. Stay calm and professional even when frustrated. Document everything in case you need to escalate later.

Know the Timeline

Appeals take time. Expect to wait several weeks for a response. If you do not hear back within 30 days, follow up in writing. Some states require insurers to respond within specific timeframes. Check your state insurance department's website to learn the exact rules in your area.

Documentation Checklist for Your Appeal

Strong documentation can turn a denied roof insurance claim into an approved one. Gather these items before submitting your appeal.

Photos and Videos

Dated photos of damage from multiple angles

Close-up shots showing specific problem areas

Wide shots showing the overall roof condition

Video walkthrough if possible

Before photos showing pre-damage condition

Written Records

Original claim paperwork

Denial letter with specific reasons listed

Your policy documents including declarations page

Any correspondence with your insurer

Notes from phone conversations

Professional Reports

Independent roof inspection report

Contractor repair estimates (get at least two)

Engineering report if structural damage is involved

Supporting Evidence

Weather data from the National Weather Service

Local news reports about the storm or event

Before photos if you have them

Maintenance records showing you cared for the roof

Permits for any previous roof work

Timeline Documentation

Date damage occurred

Date you noticed the damage

Date you filed your claim

All communication dates with insurer

Appeal deadline

When to Get Professional Help

Sometimes the appeals process needs expert support. Here is when bringing in professionals makes sense.

Consult an Attorney When

Your insurer is acting in bad faith. You suspect fraud or deliberate misrepresentation. The claim involves substantial money and multiple denials. You are considering legal action against the insurance company.

Insurance attorneys handle cases where the company has not acted fairly. They can review your case and advise whether legal action makes sense. Many offer free initial consultations.

Get a Second Roof Inspection When

The adjuster's findings do not match what you see. You need expert testimony about the cause of damage. The repair estimate seems unreasonably low. You want an unbiased professional opinion to support your appeal.

An independent inspector provides an assessment focused on your interests, not the insurance company's bottom line.

Know the Cost-Benefit

Before hiring help, consider the potential payout versus the cost. Public adjusters typically charge 10 to 15 percent. Attorneys may work on contingency, taking 25 to 40 percent if you win. For smaller claims under $5,000, the math may not work in your favor. For larger claims, professional help often pays for itself.

Understanding how to get insurance to pay for roof replacement starts with knowing your rights and building a strong case. Whether you handle the appeal yourself or bring in help, proper documentation and persistence are your best tools.