If your insurance company just asked about your roof's age, you're probably worried. Here's what you need to know.

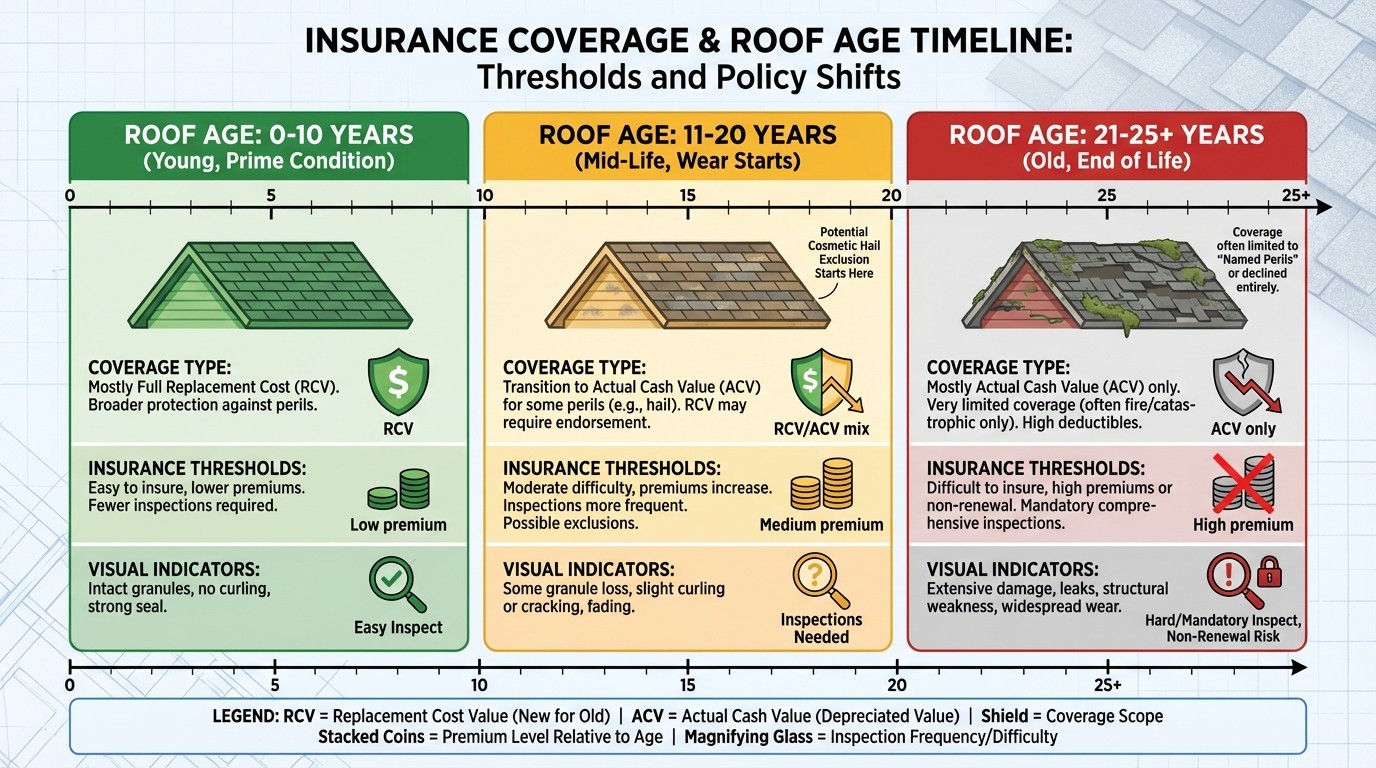

The short answer: whether insurance covers a 20-year-old roof depends on three key factors. First, your policy type matters. Replacement Cost Value (RCV) policies pay full replacement costs, while Actual Cash Value (ACV) policies deduct depreciation based on age. Second, the cause of damage determines coverage. Storm damage is typically covered, but wear and tear from age never is. Third, your roof's condition matters more than age alone.

This guide breaks down exactly when insurance covers a 20-year-old roof, how much they'll pay, and what you can do to maximize your claim.

Quick Answer: What to Expect with a 20-Year-Old Roof

Most insurance companies will cover storm damage on a 20-year-old roof. However, you'll likely receive Actual Cash Value (ACV) payout, not full replacement cost. This means they'll deduct depreciation based on your roof's age.

A 20-year-old roof typically qualifies for coverage when damage results from covered perils like storms or hail. Age alone doesn't disqualify you from coverage. What matters is the cause of damage. Sudden storm damage qualifies for coverage, while gradual deterioration from normal aging does not.

The reality: on a 20-year asphalt shingle roof, expect to pay significant out-of-pocket costs even when insurance covers the damage. Your payout might be 40-60% less than full replacement cost due to depreciation.

Why Insurance Companies Care About Roof Age

Insurance companies assess risk when setting coverage terms, and older roofs represent higher risk for claims.

For asphalt shingles, the most common roofing material, the expected lifespan is 20-25 years, according to roofing industry standards. At 20 years, an asphalt roof is nearing the end of its useful life. Statistical failure rates increase sharply after 15-20 years as shingles become brittle, lose protective granules, and develop cracks from UV exposure.

Metal roofs last 40-70 years, and tile roofs can last 50+ years. Insurance companies adjust their policies based on these material lifespans. A 20-year-old metal roof is considered mid-life, while a 20-year-old asphalt roof is near end-of-life.

Companies want to avoid paying for "predictable" failures. When a roof fails from age-related deterioration rather than sudden storm damage, that's a maintenance issue, not an insurable event. This is why age becomes a factor in coverage decisions and payout amounts.

ACV vs RCV: Understanding Your Coverage Type

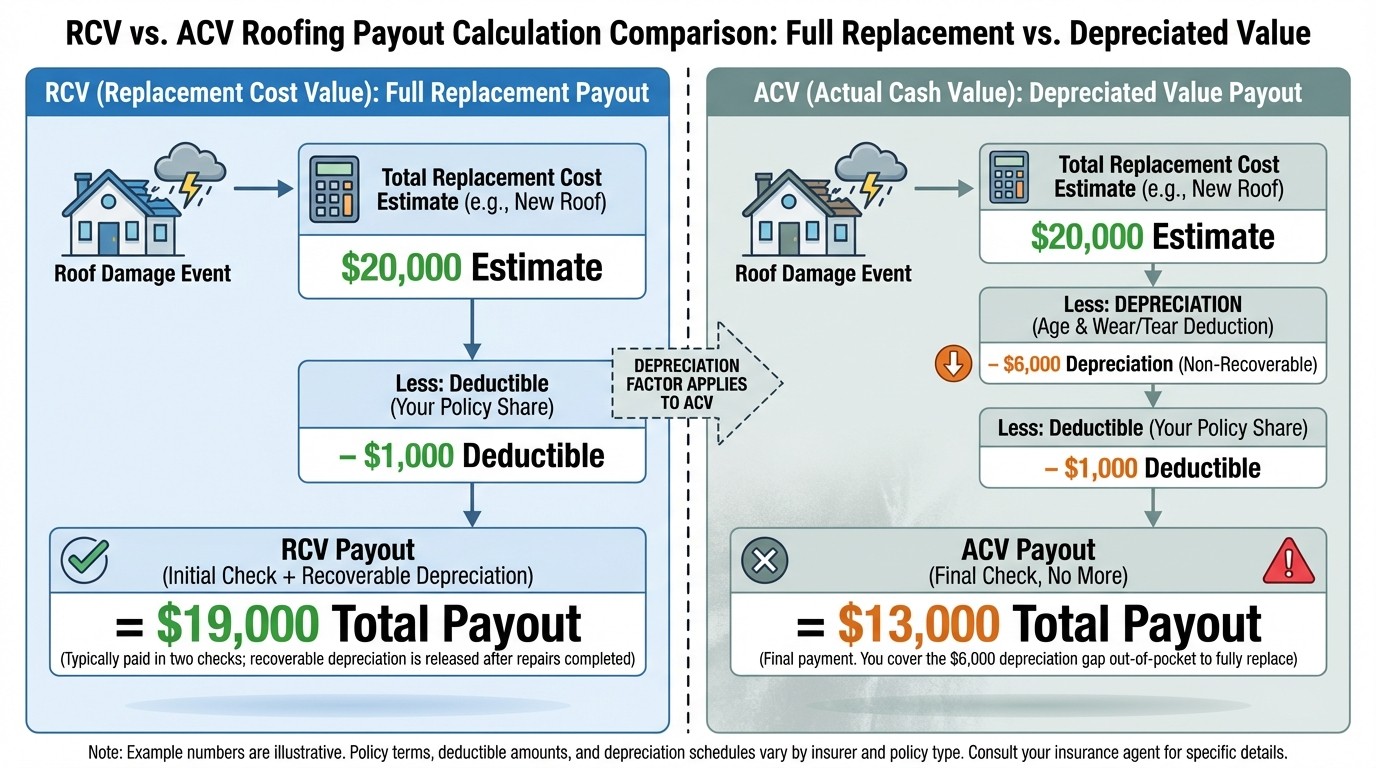

Understanding the difference between Actual Cash Value and Replacement Cost Value is critical for older roofs.

Replacement Cost Value (RCV) pays the full cost to replace your roof with new materials. There's no deduction for depreciation. If replacement costs $15,000, RCV pays $15,000 (minus your deductible).

Actual Cash Value (ACV) pays replacement cost minus depreciation based on age and condition, according to the Insurance Information Institute. Many insurance companies use approximately 5% depreciation per year after the first 10 years for asphalt shingles.

Dollar Example: A $15,000 roof replacement at 20 years old with 50% depreciation = $7,500 ACV payout. You'd pay the remaining $7,500 out of pocket, plus your deductible.

Insurance companies typically switch from RCV to ACV coverage around the 15-20 year mark for asphalt shingles. The difference is substantial. RCV means you can replace your roof. ACV often requires significant self-funding. Check the average roof replacement cost in your area.

Age Cutoffs by Insurance Company

Insurance company policies vary, but general patterns exist across major carriers:

Company | Typical Age Threshold | Coverage After Threshold |

|---|---|---|

State Farm | 20 years | ACV only after 20 years |

Allstate | 20 years | Inspection required, ACV likely |

USAA | 25 years | More flexible for maintained roofs |

Liberty Mutual | 15-20 years | Varies by state and material |

Farmers | 20 years | State-specific, typically ACV |

State Farm and Allstate typically impose stricter limits, switching to ACV-only coverage after 20 years. USAA offers more flexibility, sometimes extending to 25 years for well-maintained roofs.

Florida and coastal states often have stricter requirements due to hurricane risk. Metal and tile roofs may qualify for extended coverage due to longer lifespans.

Note: Policies vary by state and material. Verify with your agent.

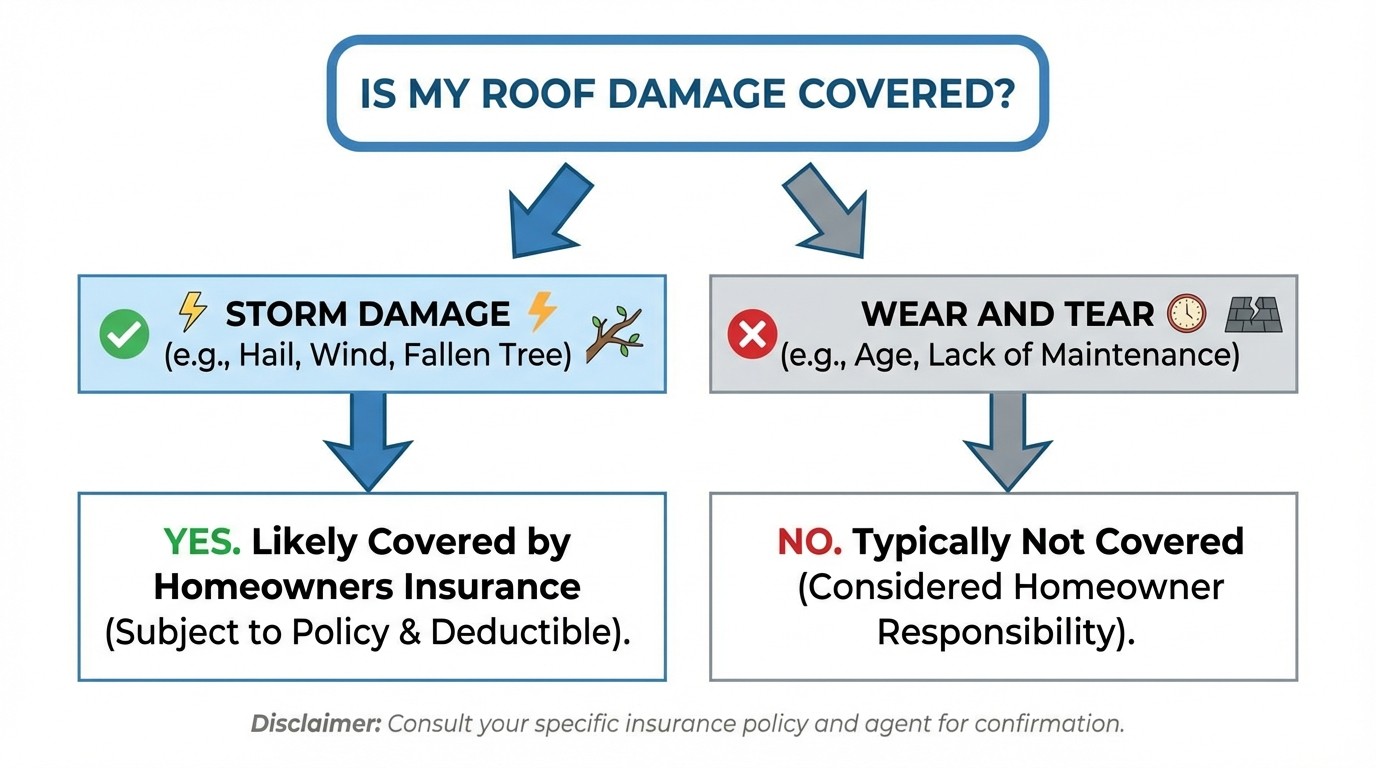

Storm Damage vs Normal Wear and Tear

The critical distinction is whether damage resulted from a sudden covered event or gradual aging. Insurance regulators recommend understanding your policy's specific coverage for different damage types.

Insurance WILL Cover (Storm Damage):

Wind damage from hurricanes, tornadoes, or severe storms

Hail damage (if policy includes hail coverage)

Fallen tree damage from storms

Fire damage from lightning

Sudden, accidental damage from external forces

Insurance WON'T Cover (Wear and Tear):

Gradual deterioration from aging

Missing granules from normal weathering

Cracking or curling from temperature cycles

Poor maintenance or deferred repairs

Cosmetic damage that doesn't compromise roof function

Slow leaks from degraded flashing

Adjusters look for evidence of sudden external force. Fresh hail dents, torn shingles, or punctures indicate covered events. Widespread granule loss or uniform cracking suggests age-related failure.

Even on a 20-year-old roof, new storm damage is typically covered (at ACV). Use this storm damage checklist to document damage.

What is the Actual Cash Value of a 20-Year-Old Roof?

Actual Cash Value varies significantly based on roofing material because different materials have different expected lifespans and depreciation rates.

Asphalt Shingles (20-25 year lifespan):

Years 1-10: Minimal depreciation, typically 0-10%

Years 11-20: Approximately 5% depreciation per year

At 20 years: Roughly 50% depreciation

Example: $12,000 replacement cost = $6,000 ACV payout

Metal Roofing (40-70 year lifespan):

Much slower depreciation rate, approximately 2% per year

At 20 years: Still retains about 60% of value

Example: $25,000 replacement cost = $15,000 ACV payout

Tile Roofing (50+ year lifespan):

Depreciation around 3% per year

At 20 years: Approximately 40% depreciation

Example: $30,000 replacement cost = $18,000 ACV payout

Material matters significantly. A 20-year-old metal or tile roof retains substantially more insurable value than a 20-year-old asphalt roof. This difference can mean thousands of dollars in payout.

Depreciation formulas vary by insurance company. Some use straight-line depreciation, while others accelerate depreciation after specific age thresholds. Your policy documents should specify the calculation method.

How to Get Coverage for Your Older Roof

Homeowners with aging roofs can take specific actions to maintain coverage and maximize claims.

Maintain Documentation: Keep inspection reports, maintenance receipts, and roof condition photographs. Before storm season, photograph your roof to establish pre-damage condition.

Schedule Regular Inspections: Annual professional inspections demonstrate proactive maintenance. Reports showing ongoing care can prevent denials and support better payouts.

Act Fast After Storms: Document damage within 24-48 hours. Take photos from multiple angles. File claims promptly. Delays complicate claims.

Know Your Policy Terms: Review whether you have ACV or RCV coverage. Understand your deductible. Check for roof age exclusions.

Consider Preemptive Replacement: If your roof is 18-19 years old with RCV coverage, replacing before the 20-year cutoff may be strategic. Learn about filing a roof claim successfully.

When Insurance Will (and Won't) Cover Your 20-Year-Old Roof

Understanding exactly what qualifies for coverage helps set realistic expectations.

Insurance WILL Cover (with ACV payout):

Wind damage from hurricanes, tornadoes, and straight-line winds exceeding 50 mph

Hail damage when policy includes hail coverage provisions

Fire damage from lightning strikes or external fire sources

Fallen tree damage from storms

Vandalism or malicious damage to the roof

Insurance WON'T Cover:

Normal aging and deterioration from weather exposure

Deferred maintenance or neglectful upkeep

Cosmetic damage that doesn't compromise roof function

Roofs already failing before the covered event occurred

Damage resulting from lack of proper maintenance

Gradual leaks from old, deteriorated flashing

The critical rule: Damage must be sudden and caused by a covered peril. Age affects payout amount through depreciation (ACV vs RCV), not coverage eligibility. The distinction matters because many homeowners assume age automatically disqualifies them.

Will Insurance Cover a 15-Year-Old Roof?

Yes, insurance typically covers a 15-year-old roof with full Replacement Cost Value (RCV) coverage for covered events.

At 15 years, asphalt shingles remain well within their expected 20-25 year lifespan. Most insurance companies don't impose age-related restrictions until roofs reach 20+ years. You'll generally receive full replacement cost payouts without significant depreciation deductions.

Condition still matters. A poorly maintained 15-year-old roof with existing damage could face coverage restrictions or claim denials. Regular maintenance and documentation remain important even at this age.

At 15 years, you're in a much better position than at 20 years. This is an ideal time to document your roof's condition with photos and inspection reports to maintain your coverage advantage.

Will Insurance Cover a 25-Year-Old Roof?

Coverage for 25-year-old asphalt roofs is very difficult. Most insurance companies set maximum age limits between 20-25 years.

At 25 years, asphalt shingles have exceeded their expected lifespan. ACV-only coverage is almost guaranteed, meaning your payout will be minimal due to complete or near-complete depreciation. Many companies won't write new policies on 25-year roofs at all.

Storm damage may still technically be covered, but the payout often doesn't justify filing a claim. For example, a $15,000 roof at 25 years old (at or beyond its 25-year lifespan) might result in a $0-$1,500 ACV payout after depreciation.

Some states have laws protecting homeowners from non-renewal based solely on roof age. Check your state's insurance regulations for specific protections.

At 25 years, proactive replacement is usually financially smarter than waiting for storm damage and filing a claim for minimal payout.

Alternative Options When Insurance Denies Coverage

When insurance denies coverage or provides insufficient payout for your 20-year-old roof, homeowners have several financing alternatives.

Roof Financing Programs: Many contractors offer promotional 0% APR financing for 12-24 months on roof replacements. FHA 203(k) renovation loans and home improvement loans provide another path for funding necessary roof work.

Contractor Payment Plans: Most roofing companies offer in-house financing options, allowing you to spread costs over 6-24 months. Terms vary, but this option avoids credit checks required by traditional loans.

Home Equity Options: A Home Equity Line of Credit (HELOC) or cash-out refinance can fund roof replacement if rates are favorable. These options work best if you have significant home equity.

Emergency Repair Priorities: If full replacement isn't immediately affordable, prioritize critical leak repairs. Temporary solutions can prevent interior water damage while you arrange financing.

Explore roof financing options to understand available programs.